As technology continues to evolve, the financial industry is rapidly adapting to stay ahead. From the integration of AI to the rise of blockchain and personal finance apps, these trends are shaping the future of finance. Here are the top 8 financial trends to watch in 2024 and 2025.

1. Financial Services Leverage Generative AI Solutions

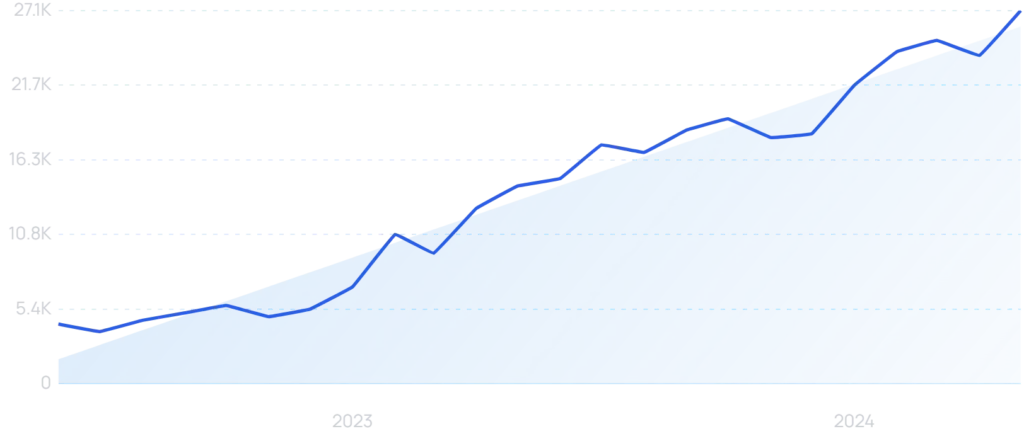

AI has the potential to revolutionize the financial services industry. Searches for “AI in finance” have surged by 525% in the past 24 months, indicating growing interest and adoption. Large language models (LLMs) like ChatGPT are being used for various applications:

- Fraud Detection: AI excels at identifying patterns, making it ideal for spotting fraudulent transactions.

- Credit Scoring and Underwriting: AI can quickly analyze large datasets to assess the risk of lending to individuals or businesses.

- Market Analysis: Tools like Claude and ChatGPT help financial professionals analyze massive amounts of data to identify market opportunities.

- RegTech: LLMs can assist in identifying and reporting regulatory and compliance issues.

- Knowledge Extraction: AI can extract insights from documents, such as Form S-1 filings, by enabling users to “chat with” the documents.

NVIDIA reports that AI is already being adopted by financial institutions worldwide, with Gartner estimating that 80% of CFOs plan to invest more in AI tools over the next two years.

2. The Finance Industry Embraces Blockchain

Interest in blockchain technology has risen by 550% in the last decade. Initially associated with cryptocurrency, blockchain is now being integrated into traditional financial systems. Banks use blockchain for cheaper, more efficient transactions with enhanced security. Examples include HSBC and Wells Fargo using blockchain for forex trades and PayPal, Mastercard, and JP Morgan allowing blockchain-based payments.

3. More People Use Personal Finance Apps

Personal finance apps are experiencing explosive growth, with approximately 250 billion downloads per year. These apps offer users the ability to manage their finances, invest in stocks and crypto, and even earn rewards. The US’s adoption of open banking will enhance the security of these apps, encouraging even more users to manage their finances digitally. Square’s Cash App remains the most popular, with a significant rise in search interest.

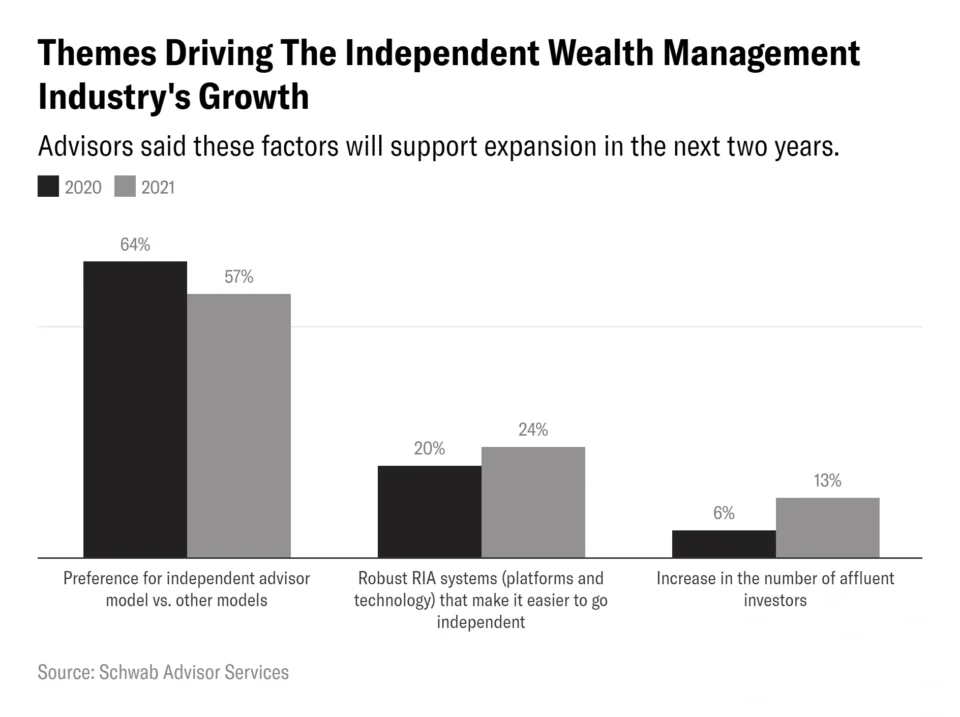

4. More Consumers Get Their Money Professionally Managed

Registered Investment Advisers (RIAs) are becoming the preferred choice for wealth management due to their fiduciary duty to act in their clients’ best interests. The RIA industry is growing, with firms managing $114.1 trillion in assets for 61.9 million clients annually. This trend indicates a shift towards more personalized and trustworthy financial advisory services.

5. Loyalty Programs Drive Repeat Business

Loyalty programs are becoming essential in the financial services industry. These programs encourage customer retention and increased spending. CitiBank’s “thankyou” rewards program is an example, offering points for using mobile apps or ATMs. McKinsey & Company found that consumers in paid loyalty programs are significantly more likely to spend more on that brand.

6. Banks Further Embrace The Cloud

The pandemic accelerated the banking industry’s move to cloud services. IDC estimates that global spending on cloud services will surpass $1.3 trillion by 2025. Major banks like JPMorgan Chase are transitioning to cloud-native platforms. AI, integrated with cloud services, enhances capabilities such as transaction analysis and fraud monitoring, making cloud solutions increasingly appealing to financial institutions.

7. Banks (Mostly) Move Past Overdraft Fees

Overdraft fees are decreasing, with many banks implementing features to help customers avoid these charges. For example, Bank of America’s Balance Connect allows automatic transfers to prevent overdrafts, and PNC’s Low Cash Mode lets customers reorder transactions. These changes are driven by regulatory pressure and the need to maintain customer loyalty.

8. More Non-Tech People Get Into Crypto

Cryptocurrency is becoming more mainstream, with market capitalization reaching around $2.7 trillion. Venture capital investment in blockchain companies has surged, and regulatory measures like reporting requirements for crypto exchanges are being implemented. The introduction of Bitcoin and Ethereum ETFs on the New York Stock Exchange and the acceptance of Bitcoin as legal tender in countries like El Salvador further indicate the growing acceptance of crypto.

Conclusion

The finance industry is undergoing a significant transformation, driven by technological advancements and changing consumer preferences. From AI and blockchain to personal finance apps and cloud banking, these trends highlight the shift towards digital and more efficient financial services. As we move forward, staying informed about these trends will be crucial for both financial institutions and consumers.